Implantable Polymer Microdevices in 2025: Transforming Healthcare with Next-Gen Biocompatible Solutions. Explore the Market Forces, Breakthrough Technologies, and Future Outlook Shaping This Rapidly Evolving Sector.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size, Growth Forecasts, and Regional Analysis (2025–2030)

- Core Technologies: Advances in Polymer Materials and Microfabrication

- Major Players and Strategic Partnerships (Company Profiles & Official Sources)

- Regulatory Landscape and Standards (FDA, ISO, and Industry Bodies)

- Clinical Applications: Neuromodulation, Drug Delivery, and Beyond

- Manufacturing Innovations and Supply Chain Developments

- Challenges: Biocompatibility, Longevity, and Miniaturization

- Investment, M&A Activity, and Funding Trends

- Future Outlook: Emerging Opportunities and Disruptive Innovations

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

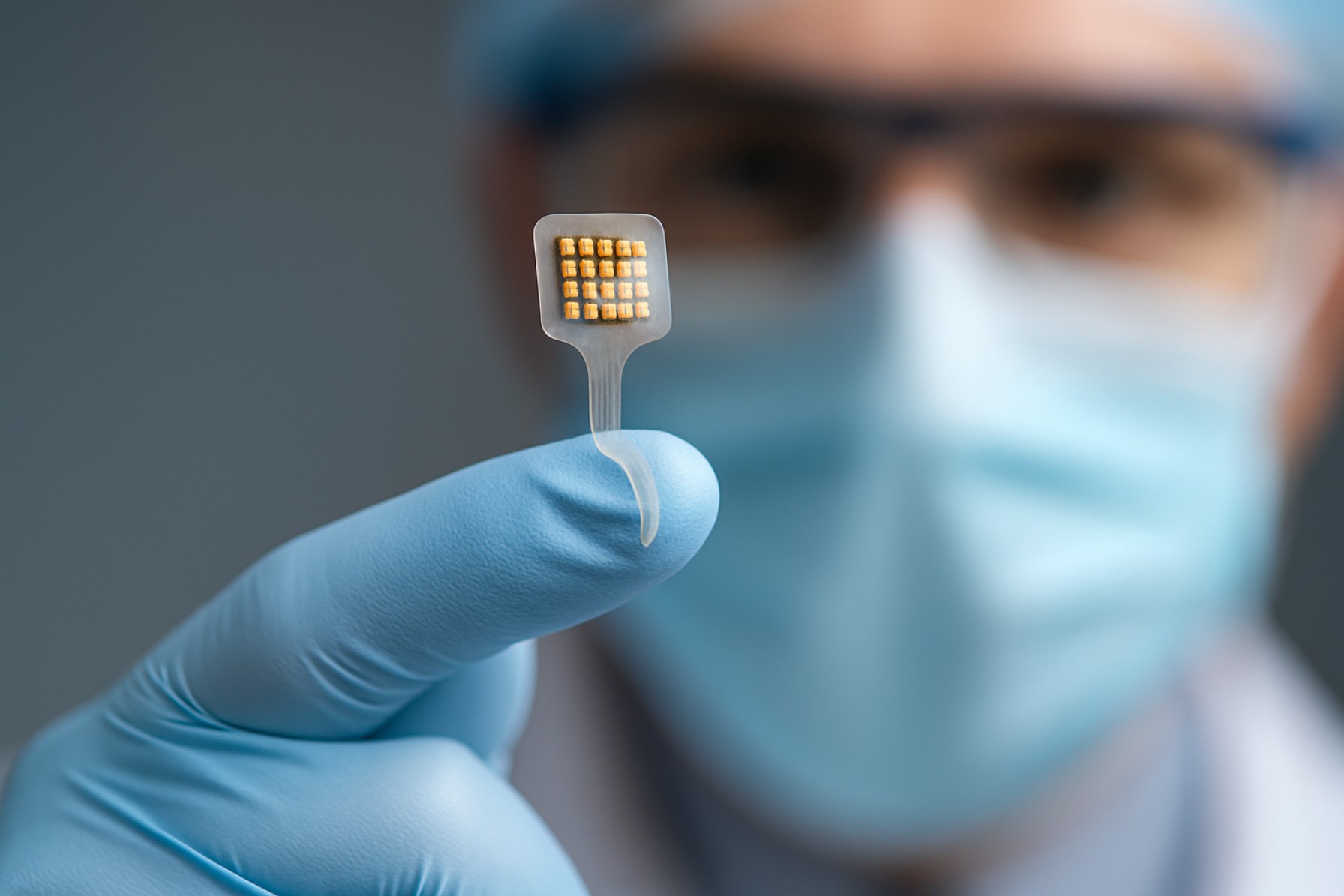

The landscape for implantable polymer microdevices is rapidly evolving in 2025, driven by advances in materials science, miniaturization, and the growing demand for personalized and minimally invasive medical solutions. These microdevices, fabricated from biocompatible polymers, are increasingly being integrated into applications such as neural interfaces, drug delivery systems, biosensors, and cardiovascular implants. The sector is witnessing robust growth, propelled by the convergence of healthcare digitization, patient-centric care models, and the need for long-term, reliable implantable solutions.

A key trend in 2025 is the shift toward flexible and bioresorbable polymers, which enable devices to conform to complex anatomical structures and reduce the risk of chronic inflammation. Companies like Medtronic and Boston Scientific are at the forefront, leveraging advanced polymer technologies to develop next-generation neurostimulation and cardiac rhythm management devices. These firms are investing heavily in R&D to enhance device longevity, wireless communication capabilities, and integration with digital health platforms.

Another significant driver is the increasing adoption of polymer-based microfluidic systems for targeted drug delivery and in vivo diagnostics. Firms such as Abbott are expanding their portfolios to include polymer microdevices that offer precise, programmable drug release and real-time monitoring of physiological parameters. The use of polymers like polyimide, Parylene, and polylactic acid (PLA) is enabling the creation of devices that are not only biocompatible but also capable of complex functionalities at the microscale.

Regulatory agencies are also playing a pivotal role in shaping the market. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are streamlining approval pathways for innovative polymer-based implants, recognizing their potential to address unmet clinical needs. This regulatory support is expected to accelerate commercialization timelines and foster greater collaboration between device manufacturers and healthcare providers.

Looking ahead, the outlook for implantable polymer microdevices remains highly positive. The next few years are expected to see further integration of artificial intelligence and wireless telemetry, enabling smarter, more adaptive implants. Strategic partnerships between medical device giants and specialized polymer manufacturers, such as Evonik Industries—a leader in medical-grade polymers—are anticipated to drive innovation and scalability. As the global population ages and the prevalence of chronic diseases rises, the demand for advanced, patient-friendly implantable solutions is set to grow, positioning polymer microdevices as a cornerstone of future medical technology.

Market Size, Growth Forecasts, and Regional Analysis (2025–2030)

The global market for implantable polymer microdevices is poised for robust growth between 2025 and 2030, driven by advances in biomedical engineering, miniaturization technologies, and the increasing adoption of biocompatible polymers in medical implants. These microdevices, which include sensors, drug delivery systems, and neurostimulation devices, are increasingly favored for their flexibility, reduced immune response, and potential for integration with wireless and smart technologies.

In 2025, the market is estimated to be valued in the low single-digit billions (USD), with projections indicating a compound annual growth rate (CAGR) exceeding 10% through 2030. This growth is underpinned by rising demand for minimally invasive medical procedures, the expanding prevalence of chronic diseases, and the ongoing shift toward personalized medicine. North America currently leads the market, attributed to its advanced healthcare infrastructure, high R&D investment, and the presence of major industry players. Europe follows closely, with significant activity in Germany, Switzerland, and the Nordic countries, where medical device innovation is strongly supported by both public and private sectors.

Asia-Pacific is expected to witness the fastest growth over the forecast period, fueled by increasing healthcare expenditure, rapid urbanization, and government initiatives to modernize healthcare systems. Countries such as Japan, South Korea, and China are investing heavily in medical device manufacturing and regulatory harmonization, which is expected to accelerate the adoption of implantable polymer microdevices in the region.

Key companies shaping the market landscape include Medtronic, a global leader in medical technology that has developed polymer-based neurostimulation and cardiac devices, and Boston Scientific, which offers a range of implantable devices utilizing advanced polymer materials for enhanced biocompatibility and performance. Smith & Nephew is also active in the field, particularly in orthopedic and wound care applications, leveraging polymer microdevices for improved patient outcomes. In the Asia-Pacific region, Terumo Corporation is notable for its innovation in minimally invasive polymer-based implants and delivery systems.

Looking ahead, the market outlook remains highly positive, with ongoing research into next-generation polymers—such as bioresorbable and stimuli-responsive materials—expected to unlock new applications and further drive adoption. Strategic collaborations between device manufacturers, polymer suppliers, and research institutions are anticipated to accelerate product development and regulatory approvals, particularly in emerging markets. As regulatory frameworks evolve and reimbursement policies adapt to new technologies, the global implantable polymer microdevice market is set to expand significantly through 2030.

Core Technologies: Advances in Polymer Materials and Microfabrication

Implantable polymer microdevices are at the forefront of biomedical innovation, driven by rapid advances in polymer science and microfabrication techniques. In 2025, the sector is witnessing a convergence of new biocompatible polymers, scalable manufacturing processes, and miniaturization technologies, enabling devices that are smaller, more flexible, and more functional than ever before.

A key trend is the adoption of advanced polymers such as polyimide, parylene C, and polydimethylsiloxane (PDMS), which offer excellent biocompatibility, chemical stability, and mechanical flexibility. These materials are now widely used in neural probes, biosensors, and drug delivery systems. For example, Medtronic and Boston Scientific have incorporated polymer-based components into their latest neurostimulation and cardiac rhythm management devices, leveraging the polymers’ ability to conform to tissue and reduce immune response.

Microfabrication techniques have also evolved, with photolithography, soft lithography, and laser micromachining enabling the production of intricate microstructures at scale. Companies such as MicroChem and Dolomite Microfluidics supply specialized materials and equipment for fabricating microfluidic channels and electrode arrays in polymers, supporting both prototyping and commercial production. The integration of additive manufacturing (3D printing) is further accelerating innovation, allowing for rapid iteration and customization of implantable devices.

Recent years have seen the emergence of multifunctional polymer microdevices capable of sensing, stimulation, and drug delivery. For instance, Nevro and NeuroMetrix are developing next-generation neuromodulation implants with polymer-based flexible electrodes, aiming to improve patient comfort and device longevity. Meanwhile, startups and research spinouts are exploring bioresorbable polymers for temporary implants that safely degrade after use, a field supported by suppliers like Evonik Industries, which provides medical-grade resorbable polymers.

Looking ahead, the outlook for implantable polymer microdevices is robust. The ongoing refinement of polymer chemistries and microfabrication methods is expected to yield devices with enhanced integration of electronics, wireless communication, and closed-loop control. Industry leaders and material suppliers are investing in scalable, GMP-compliant manufacturing to meet anticipated regulatory and clinical demands. As a result, the next few years are likely to see broader clinical adoption and the emergence of entirely new classes of smart, minimally invasive implants.

Major Players and Strategic Partnerships (Company Profiles & Official Sources)

The landscape of implantable polymer microdevices in 2025 is shaped by a dynamic interplay of established medical device manufacturers, innovative startups, and strategic collaborations with academic and clinical partners. These devices, leveraging advanced biocompatible polymers, are increasingly central to next-generation neurostimulation, biosensing, and drug delivery systems.

Among the most prominent players, Medtronic continues to lead in the development and commercialization of implantable devices, including those utilizing polymer-based microtechnologies for neuromodulation and cardiac applications. The company’s ongoing investments in polymer microfabrication and miniaturization are evident in its expanding portfolio of neurostimulators and drug delivery implants.

Another key actor, Boston Scientific, has made significant strides in integrating polymer microdevices into its neuromodulation and pain management solutions. The company’s collaborations with polymer suppliers and microfabrication specialists have enabled the development of flexible, minimally invasive implants designed for long-term biocompatibility and patient comfort.

In the biosensing and diagnostics segment, Abbott is notable for its work on implantable glucose monitoring systems and other polymer-based sensor platforms. Abbott’s focus on continuous monitoring and wireless data transmission has driven partnerships with materials science companies to enhance device longevity and performance.

Emerging companies are also shaping the field. Nevro specializes in polymer-encapsulated spinal cord stimulation systems, while Neuralink is advancing high-channel-count neural interfaces using flexible polymer substrates for brain-computer interfacing. These firms are actively collaborating with academic research centers to accelerate clinical translation and regulatory approval.

Strategic partnerships are a hallmark of the sector’s current evolution. For example, Evonik Industries, a global leader in specialty polymers, supplies medical-grade polymers to device manufacturers and has established joint development agreements to tailor materials for specific implantable applications. Similarly, DSM (now part of dsm-firmenich) provides high-performance biomedical polymers and collaborates with device makers to optimize biostability and mechanical properties.

Looking ahead, the next few years are expected to see further consolidation and cross-sector partnerships, particularly as regulatory pathways for novel polymer microdevices become clearer. The integration of advanced manufacturing techniques, such as 3D microprinting and soft lithography, is anticipated to accelerate, with companies like Stratasys and 3D Systems poised to play supporting roles in prototyping and production. As the market matures, collaborations between device manufacturers, polymer suppliers, and clinical institutions will be critical in driving innovation and ensuring patient safety.

Regulatory Landscape and Standards (FDA, ISO, and Industry Bodies)

The regulatory landscape for implantable polymer microdevices is evolving rapidly as these technologies become increasingly central to next-generation medical therapies. In 2025, the U.S. Food and Drug Administration (FDA) continues to play a pivotal role in setting the standards for safety, efficacy, and quality of such devices. The FDA’s Center for Devices and Radiological Health (CDRH) oversees the premarket approval (PMA) and 510(k) clearance processes, with a growing emphasis on biocompatibility, long-term stability, and device-tissue interactions specific to polymer-based implants. The FDA’s guidance documents, such as those on biocompatibility evaluation (ISO 10993 series), are frequently updated to reflect advances in polymer science and microfabrication techniques. In recent years, the FDA has also expanded its Breakthrough Devices Program, which accelerates the review of innovative implantable devices, including those utilizing advanced polymers for neural interfaces and drug delivery systems (U.S. Food and Drug Administration).

Internationally, the International Organization for Standardization (ISO) remains the primary body for harmonizing standards related to implantable medical devices. ISO 13485, which specifies requirements for a quality management system, and ISO 10993, which addresses biological evaluation of medical devices, are particularly relevant. The ISO 10993 series is under continuous revision to address the unique challenges posed by novel polymer chemistries and microdevice architectures. In 2025, updates are expected to further clarify requirements for extractables and leachables testing, as well as long-term degradation products, which are critical for polymer-based implants (International Organization for Standardization).

Industry bodies such as the Advanced Medical Technology Association (AdvaMed) and the Medical Device Innovation Consortium (Medical Device Innovation Consortium) are actively collaborating with regulators and manufacturers to develop best practices and consensus standards. These organizations facilitate pre-competitive research, regulatory science initiatives, and the development of technical standards that address the unique properties of implantable polymers, such as flexibility, miniaturization, and integration with electronics.

Looking ahead, the regulatory outlook for implantable polymer microdevices is expected to become more nuanced, with increased attention to device-specific risk assessments, real-world evidence, and post-market surveillance. Regulatory agencies are also exploring the use of digital tools and artificial intelligence to streamline submissions and monitor device performance. As the field matures, close collaboration between manufacturers, regulators, and standards organizations will be essential to ensure patient safety while fostering innovation in polymer-based implantable technologies.

Clinical Applications: Neuromodulation, Drug Delivery, and Beyond

Implantable polymer microdevices are rapidly transforming clinical practice, particularly in neuromodulation and targeted drug delivery. As of 2025, these devices leverage the unique properties of advanced polymers—such as flexibility, biocompatibility, and tunable degradation rates—to address limitations of traditional metal or ceramic implants. Their miniaturized form factors and customizable architectures enable precise interfacing with biological tissues, opening new frontiers in chronic disease management and personalized medicine.

In neuromodulation, polymer-based microelectrode arrays are being deployed for the treatment of conditions like Parkinson’s disease, epilepsy, and chronic pain. Companies such as Nevro and Boston Scientific are advancing spinal cord stimulation systems that incorporate polymeric components to improve flexibility and reduce tissue irritation. These devices can conform more closely to neural structures, enhancing stimulation specificity and patient comfort. Additionally, startups and research groups are developing fully soft, stretchable neural interfaces using materials like polyimide and parylene, which are expected to enter clinical trials within the next few years.

Drug delivery is another area witnessing significant innovation. Polymer microdevices can be engineered to release therapeutics in a controlled manner, either passively or in response to physiological cues. Medtronic has pioneered implantable infusion pumps for chronic pain and spasticity, utilizing polymer reservoirs and catheters for reliable, long-term drug administration. Meanwhile, companies like Insulet are expanding the use of polymer-based microdevices for automated insulin delivery, with next-generation systems aiming for fully implantable, closed-loop glucose management.

Beyond neuromodulation and drug delivery, polymer microdevices are being explored for biosensing, tissue regeneration, and even cancer therapy. For example, bioresorbable polymer scaffolds embedded with microelectronics are under development for temporary cardiac pacing and nerve regeneration, with several prototypes expected to reach first-in-human studies by 2026. The adaptability of polymers also supports the integration of wireless communication modules, enabling remote monitoring and adjustment of device parameters—a feature increasingly prioritized by manufacturers such as Abbott.

Looking ahead, the clinical landscape for implantable polymer microdevices is poised for rapid expansion. Regulatory approvals are anticipated to accelerate as long-term safety and efficacy data accumulate. The convergence of polymer science, microfabrication, and digital health is expected to yield devices that are not only more effective but also less invasive and more patient-friendly, heralding a new era in precision medicine.

Manufacturing Innovations and Supply Chain Developments

The manufacturing landscape for implantable polymer microdevices is undergoing significant transformation in 2025, driven by advances in materials science, microfabrication techniques, and supply chain integration. The demand for miniaturized, biocompatible devices for applications such as neural interfaces, drug delivery, and biosensing is pushing manufacturers to adopt novel production methods and streamline logistics.

One of the most notable trends is the increasing use of advanced polymers such as polyimide, Parylene C, and medical-grade silicones, which offer superior flexibility, chemical resistance, and long-term biocompatibility. Companies like DuPont are at the forefront, supplying high-performance polyimide films tailored for medical microdevices. These materials enable the fabrication of ultra-thin, flexible substrates that can conform to complex anatomical structures, a key requirement for next-generation implantables.

Microfabrication techniques are also evolving rapidly. The adoption of high-precision laser micromachining, photolithography, and 3D microprinting is enabling the production of intricate device architectures at scale. Stratasys, a leader in additive manufacturing, has expanded its portfolio to include biocompatible 3D printing materials and systems suitable for prototyping and limited-run production of implantable devices. This shift towards additive manufacturing is reducing lead times and allowing for greater customization, which is particularly valuable for patient-specific implants.

On the supply chain front, manufacturers are increasingly integrating vertically to ensure quality and traceability of critical components. Nordson Corporation, known for its precision dispensing and fluid management technologies, has expanded its medical solutions division to offer turnkey manufacturing services for polymer-based microdevices, including cleanroom assembly and packaging. This integration helps mitigate risks associated with contamination and regulatory compliance, both of which are paramount in the medical device sector.

Globalization of the supply chain remains a double-edged sword. While it enables access to specialized materials and fabrication expertise, it also exposes manufacturers to geopolitical risks and logistical disruptions. In response, companies are investing in regional manufacturing hubs and digital supply chain management tools to enhance resilience. For example, Evonik Industries, a major supplier of medical-grade polymers, has expanded its production facilities in North America and Europe to better serve local device manufacturers and reduce dependency on transcontinental shipping.

Looking ahead, the convergence of smart manufacturing, advanced materials, and robust supply chain strategies is expected to accelerate the commercialization of implantable polymer microdevices. As regulatory pathways become clearer and manufacturing standards mature, the sector is poised for rapid growth, with increased collaboration between material suppliers, device manufacturers, and healthcare providers shaping the future landscape.

Challenges: Biocompatibility, Longevity, and Miniaturization

Implantable polymer microdevices are at the forefront of next-generation medical technologies, offering unprecedented opportunities for diagnostics, therapy, and patient monitoring. However, as the field advances into 2025 and beyond, several critical challenges remain—chief among them are biocompatibility, device longevity, and the ongoing drive toward further miniaturization.

Biocompatibility remains a fundamental concern. Polymers such as polyimide, parylene C, and silicone elastomers are widely used due to their flexibility and processability, but their long-term interaction with biological tissues is not fully resolved. Chronic implantation can trigger foreign body responses, leading to encapsulation or degradation of device performance. Companies like Medtronic and Boston Scientific are actively developing surface modifications and coatings to mitigate inflammatory responses and improve integration with host tissues. For example, hydrophilic coatings and bioactive surface treatments are being explored to reduce protein adsorption and cellular adhesion, which are key contributors to device encapsulation.

Longevity is closely tied to biocompatibility but also hinges on the intrinsic stability of polymer materials in the physiological environment. Hydrolysis, oxidation, and mechanical fatigue can all compromise device function over time. The industry is responding with new polymer formulations and encapsulation strategies. Covestro, a major supplier of medical-grade polymers, is investing in advanced polyurethane and polycarbonate blends designed for extended durability in vivo. Meanwhile, DuPont continues to refine its medical-grade silicones and polyimides, focusing on improved resistance to body fluids and sterilization processes.

Miniaturization is a persistent challenge as devices become more complex and multifunctional. The demand for smaller, less invasive implants is driving innovation in microfabrication and assembly techniques. ZEISS and Olympus Corporation are leaders in precision optics and micro-manufacturing, providing tools and processes that enable the production of sub-millimeter polymer components with integrated electronics. The integration of wireless power and data transmission, as pursued by STMicroelectronics, is also critical for reducing device size while maintaining functionality.

Looking ahead, the convergence of advanced materials science, microfabrication, and bioengineering is expected to yield polymer microdevices with improved biocompatibility, longer operational lifespans, and even smaller footprints. However, regulatory hurdles and the need for extensive in vivo validation will continue to shape the pace of clinical adoption through the next several years.

Investment, M&A Activity, and Funding Trends

The investment landscape for implantable polymer microdevices is experiencing notable momentum in 2025, driven by advances in biocompatible materials, miniaturization, and the expanding applications in neuromodulation, drug delivery, and biosensing. Venture capital and strategic corporate investments are increasingly targeting startups and established players developing next-generation polymer-based implants, reflecting confidence in the sector’s growth trajectory.

Key industry leaders such as Medtronic and Boston Scientific continue to allocate significant R&D budgets toward polymer microdevice innovation, particularly for neurostimulation and cardiac applications. These companies have also been active in acquiring or partnering with smaller firms specializing in advanced polymer technologies, aiming to expand their portfolios and accelerate time-to-market for novel devices. For example, Medtronic has publicly emphasized its commitment to next-generation materials and miniaturized implantables in recent investor communications.

In 2024 and early 2025, several early-stage companies have secured substantial funding rounds. Notably, startups focusing on soft, flexible polymer microdevices for brain-computer interfaces and chronic disease management have attracted multi-million dollar Series A and B investments from both healthcare-focused venture funds and strategic investors. The growing interest is partly fueled by the increasing clinical validation of polymer-based devices, which offer improved patient comfort and device longevity compared to traditional metal or ceramic implants.

Mergers and acquisitions (M&A) activity is also intensifying. Large medical device manufacturers are seeking to acquire innovative polymer microdevice firms to gain access to proprietary fabrication techniques and intellectual property. This trend is exemplified by recent acquisitions in the neurotechnology and drug delivery segments, where established players are integrating polymer-based solutions to enhance their competitive edge.

Government and public sector funding, particularly in the United States and Europe, continues to support translational research and commercialization efforts. Agencies such as the National Institutes of Health (NIH) and the European Innovation Council are providing grants and co-investments to accelerate the development of implantable polymer microdevices for unmet clinical needs.

Looking ahead, the outlook for investment and M&A activity in this sector remains robust. The convergence of material science, microfabrication, and digital health is expected to drive further capital inflows and strategic deals through 2025 and beyond. As clinical adoption widens and regulatory pathways become clearer, the sector is poised for continued growth, with established companies like Boston Scientific and Medtronic likely to remain at the forefront of investment and acquisition activity.

Future Outlook: Emerging Opportunities and Disruptive Innovations

The landscape for implantable polymer microdevices is poised for significant transformation in 2025 and the coming years, driven by advances in materials science, miniaturization, and integration with digital health platforms. These devices, which leverage the unique properties of biocompatible polymers, are increasingly central to next-generation medical implants for diagnostics, drug delivery, and neuromodulation.

A key trend is the shift toward fully bioresorbable and flexible polymer microdevices, which can conform to soft tissue and degrade harmlessly after their therapeutic function is complete. Companies such as Evonik Industries are at the forefront, developing medical-grade polymers like poly(lactic-co-glycolic acid) (PLGA) and polycaprolactone (PCL) that are tailored for controlled degradation and compatibility with microfabrication techniques. These materials are enabling the creation of temporary implants for localized drug delivery and post-surgical monitoring, reducing the need for secondary removal surgeries.

Another area of rapid innovation is the integration of microelectronics and wireless communication within polymer-based implants. Firms like Medtronic and Boston Scientific are investing in polymer encapsulation technologies that protect sensitive electronics while maintaining device flexibility and biocompatibility. This is particularly relevant for neuromodulation devices, such as spinal cord stimulators and brain-machine interfaces, where chronic implantation and patient comfort are critical.

Emerging opportunities are also being shaped by the convergence of polymer microdevices with digital health ecosystems. The development of smart implants capable of real-time physiological monitoring and data transmission is accelerating, with companies like Siemens Healthineers exploring polymer-based sensor platforms that can interface with external devices for remote patient management. This trend is expected to drive new models of personalized medicine and continuous care, especially for chronic disease management.

Looking ahead, the next few years will likely see disruptive innovations in manufacturing, such as additive microfabrication and roll-to-roll processing, which promise to lower costs and enable high-volume production of complex polymer microdevices. Industry leaders including DSM are expanding their portfolios to include advanced polymer solutions for medical microdevices, supporting the scalability and regulatory compliance required for widespread clinical adoption.

In summary, the future outlook for implantable polymer microdevices is marked by rapid technological convergence, expanding clinical applications, and a strong push toward patient-centric, minimally invasive solutions. As regulatory pathways become clearer and manufacturing matures, the sector is set for robust growth and transformative impact on healthcare delivery.

Sources & References

- Medtronic

- Boston Scientific

- Evonik Industries

- Smith & Nephew

- Terumo Corporation

- Dolomite Microfluidics

- NeuroMetrix

- Neuralink

- DSM

- Stratasys

- 3D Systems

- International Organization for Standardization

- Medical Device Innovation Consortium

- Insulet

- DuPont

- Covestro

- ZEISS

- Olympus Corporation

- STMicroelectronics

- Siemens Healthineers